West Leechburg residents will get another chance to talk with Leechburg Area School District officials about tax rates at a meeting Thursday.

Superintendent David Keibler is organizing a town hall meeting at the West Leechburg Fire Hall.

According to a letter sent to district residents, the meeting will be a public gathering to discuss the plan to address the issues regarding a formula supplied by the State Tax Equalization Board (STEB) that tries to equalize the tax burden for all property owners.

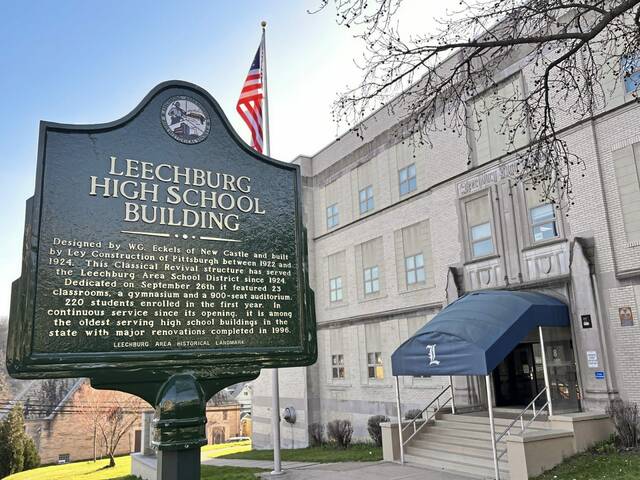

Multicounty school districts such as Leechburg Area are required by law to use the formula when calculating real estate tax rates. Leechburg Area, a district with fewer than 700 students, includes West Leechburg in Westmoreland County and Leechburg and Gilpin in Armstrong County.

West Leechburg property owners pay a higher tax rate than residents in Leechburg and Gilpin because they live in Westmoreland County, which has a different assessment rate than Armstrong County .

The tax rate in West Leechburg is 158.61 mills, more than twice the rate of 68.48 mills in Leechburg and Gilpin. That is a 10.4% (14.96 mills) increase for West Leechburg property owners and a 2.9% (2.06 mills) decrease for those in Leechburg and Gilpin from the 2023-24 budget. The difference in tax rates is common for school districts that cross county lines.

Keibler stated in the letter that, despite the school board not increasing millage rate since the 2018-19 school year, West Leechburg residents have seen an increase of 26.96 mills and Armstrong County residents have seen a decrease of 4.45 mills in the past six school years.

In an effort to relieve the school tax burden on West Leechburg residents, the district previously explored a program in which properties there that qualify for the state’s Homestead/Farmstead Exemption would receive a rebate from the district for any tax increase not offset by the exemption.

The rebate, to be paid entirely through school district funds, would not be available to property owners in Leechburg and Gilpin and caused the program to come into conflict with the Uniformity Clause.

The Uniformity Clause of the state constitution states: “All taxes shall be uniform, upon the same class of subjects, within the territorial limits of the authority levying the tax, and shall be levied and collected under general laws.”

In short, it means the district cannot offer tax relief only to West Leechburg residents.

The letter sent to residents said the district “has been threatened with litigation, so assistance is no longer an option.”

“I invite you to the first of several town hall meetings to provide information and discuss our plan to ensure (Pennsylvania Department of Education), STEB and our commissioners in Westmoreland and Armstrong counties hear our voices,” Keibler said in the letter.

In addition to the town hall meeting, the school board has called a special voting meeting for 5:30 p.m., a half-hour before the town hall at the same location.

According to the agenda posted for the meeting, the board will approve a new business manager after Teresa Edinger resigned in May to work at Lenape Technical School.