West Leechburg property owners will get some relief from years worth of tax increases, according to Leechburg Area School District Superintendent David Keibler.

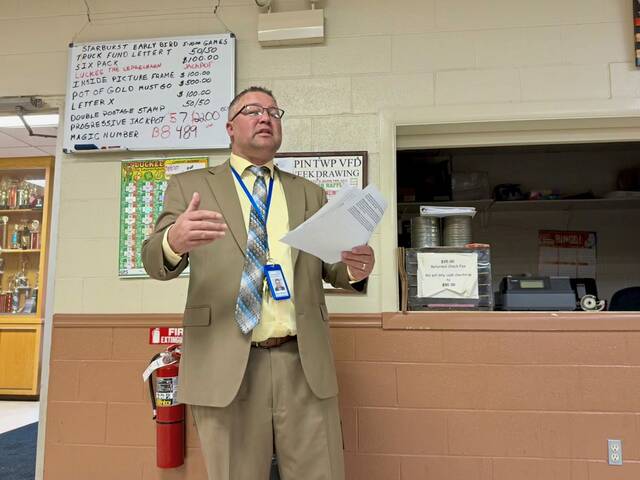

During the school board’s Town Hall Tour on Wednesday night, Keibler told residents the district plans to earmark about $58,000 in Ready to Learn Tax Equity relief funds from the state for a 2025-26 tax credit for West Leechburg residents.

The tax inequity for West Leechburg, being the school district’s only Westmoreland County community, comes from the state-mandated tax equalization ratio. That ratio is a formula required for school districts that cross county lines to make sure parts of the districts in different counties pay a proportional amount of taxes.

It’s needed because property tax assessments are not uniform and can vary greatly by county.

In Leechburg Area’s case, rather than producing equal tax bills in Gilpin, Leechburg and West Leechburg, it has produced consistent increases in West Leechburg, according to Keibler.

West Leechburg residents have seen a 26.96-mill increase in the past seven years, while Leechburg and Gilpin residents, in Armstrong County, have seen a 6.84-mill decrease. The seven-year mark was used, since it was the last time the district directly raised taxes, he said.

All subsequent millage changes have come from applying the tax ratio to properties in each community.

The current millage rate is set at 158.61 for West Leechburg, resulting in a homeowner with a median assessed property value of $18,200 paying $2,887.

For Leechburg and Gilpin, the tax rate is 68.48 mills, resulting in a homeowner with a median assessed property value of $32,600 paying $2,300.

The school board has considered a few different solutions to the taxation issue to no avail. Keibler called the tax credit a “band-aid.”

“(Pennsylvania Department of Education) approved our plan to spend that money in our budget in the upcoming year,” Keibler said.

The district has held off raising taxes to spare West Leechburg residents from being hit with a giant millage jump, Keibler said.

If the district has to continue to comply with the current State Tax Equalization Board requirements, it won’t be able to keep up with its expenditure needs and is at risk of not surviving.

“If we can’t fix this, (the district) can’t continue,” Keibler said.

While the board’s message was the same at each of three meetings held Wednesday night — one in each municipality, reactions from community members varied from town to town.

West Leechburg

For taxpayers benefiting directly from the district’s plan, the reaction was positive, with attendees giving Keibler and school board members a round of applause.

In addition to explaining the history of the situation and the action taken by the board thus far, and fielding questions from residents, Keibler said district leaders might be reaching out to residents to appeal their property assessments to help balance taxation between Westmoreland and Armstrong counties.

He said he’s also been talking to legislators for a change in STEB requirements.

“We’re talking about potentially overturning a statute that’s been around for a very long time, but there is inequality here,” said attorney Joe Dalfonso.

Dalfonso said the district is attempting to take the most cost-effective and “diplomatic” route to find a solution. He said they’re hoping to avoid a lawsuit.

Leechburg

The next meeting ended differently.

Tensions ran higher at the second stop on the Town Hall Tour. Around 10 residents showed up, with half of those having attended the previous meeting.

Leechburg resident Chuck Pascal called the plan unconstitutional since the tax credit will only go to one community out of the three that make up the school district.

“That’s a violation of the Uniformity Clause,” said Pascal, an attorney.

The Uniformity Clause of the state constitution states: “All taxes shall be uniform, upon the same class of subjects, within the territorial limits of the authority levying the tax, and shall be levied and collected under general laws.”

The district previously explored the possibility of a tax rebate.

West Leechburg properties that qualify for the state’s Homestead/Farmstead Exemption would have received a rebate from the district for any tax increase not offset by the exemption.

But Pascal argued, since the rebate would have been paid entirely through school district funds and would not be available to property owners in Leechburg and Gilpin, that plan also violated the Uniformity Clause.

Dalfonso told TribLive the current credit plan is allowed because the school district is acting “pursuant to a statute that authorizes the Ready to Learn grant.”

Pascal said a statute cannot authorize the district to violate the constitution.

“The constitution says a taxing body cannot subcategorize taxpayers for special treatment,” Pascal said.

Keibler would have none of it.

“If you want to come fight us, go file a lawsuit. This is what we’re doing,” Keibler said, responding to Pascal.

Keibler said he appreciated the work Pascal’s been doing, by lobbying state officials to change the STEB requirements, but maintained the district “can’t keep kicking the ball down the road” because the district won’t survive the financial burden STEB presents.

Gilpin

About 16 people, six of whom attended the first two meetings, came for the Gilpin stop on the tour.

After Keibler’s presentation, audience members discussed ways to get the community involved.

Keibler emphasized that he didn’t want to pit residents against each other, but wanted to form a base to address the issue with legislators to lobby them for a law change.

A proposed budget for the district will be presented and discussed at the school board’s planning meeting at 6 p.m. on May 21 and voted on at the board’s voting meeting on the same night at the 7 p.m.