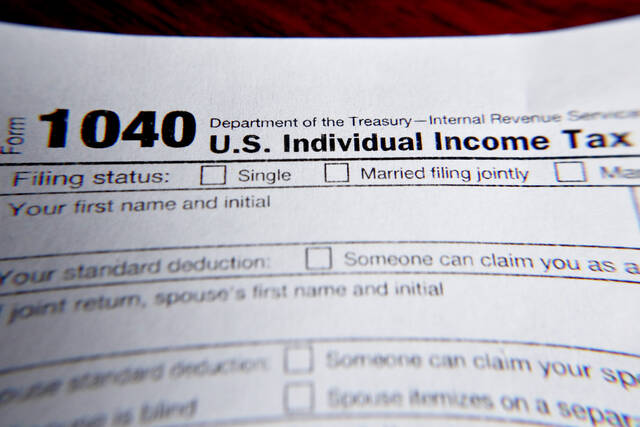

The clock has started ticking for people to file their tax returns but this year, there’s one thing to brace for — smaller refunds.

That’s because many of the benefits put in place to help people weather the pandemic — such as boosting the child tax credit and earned income tax credit (EITC) — have reverted back to their original, pre-covid formulas.

A pandemic-era tax break for charitable giving also is gone, as well as stimulus payments.

Tax season for individuals officially started Jan. 23. This year’s deadline is April 18.

“People should prepare for the fact that they will likely not see as large of a refund,” said Kim McHenry, a franchisee of H&R Block with offices in Leechburg and Vandergrift.

However, Pennsylvanians do benefit from a state child tax credit signed into law in July.

Just Harvest in Pittsburgh’s South Side offers free tax preparation for qualifying households. And the early part of the year tends to be the busiest as people are eager to get their returns.

“We have seen people getting lower refunds than last year because of the expirations of the pandemic-related benefits,” said Christie Weiland Stagno, free tax preparation coalition director. “Those have almost all expired, and that has been difficult for a lot of people. Those were the ones that affected a lot of our clients, who are lower-income families.”

Just Harvest’s tax prep services have been expanding over the years. It began offering them in 2003 when the organization was trying to raise awareness about the EITC, which is one of the largest anti-poverty programs.

“We learned that a lot of lower-income people were missing out on important tax credits and refunds,” Weiland Stagno said.

Just Harvest said the EITC can increase a family’s annual income by as much as 45%. In 2020, the credit brought more than $2 billion to 885,000 families in Pennsylvania, it said.

The organization, which is part of the Free Tax Preparation Coalition through the United Way, has expanded its tax prep services to six sites in the region and processes about 3,000 returns.

One of the pieces of advice Tara Button of Henninger Accounting Services in Greensburg offered is this: Even if you have someone else prepare your return, make sure you’ve gone through all the documents and everything is correct.

“Tax season isn’t that long for as much work that goes into it,” Button said. “And you’re paying for our time. The more organized you are, the lower your bill for us is going to be and the quicker your return is going to get processed.

“If you’re missing documents, just wait to bring everything in all at once. Don’t do it piecemeal. Otherwise it will create confusion. Wait until everything is together and complete.”

Another thing to keep in mind is that both the federal government and Pennsylvania are urging people to file online.

The IRS has information on how to file for free and check on the status of returns at irs.gov.

Pennsylvania taxpayers can visit mypath.pa.gov to file their returns through the department’s state-only filing system.

The U.S. Postal Service said there are no plans to have extended hours as the April 18 deadline approaches.

Button at Henninger Accounting suggests that if you have to mail your return, always go with the certified option so you can track your documents. And if you have to make a payment, have it debited from your account so you have proof of payment.